Press Releases

Industry Collaborates on Solutions to Speed Transaction Times

Purchase, N.Y. – May 26, 2016 – Americans are increasingly using EMV chip cards to make purchases as 68 percent of all U.S.-issued MasterCard-branded consumer credit cards feature the technology as of April 30, 2016.

Chip-active merchant locations also increased to 1.4 million during this same time; including more than 1 million – or almost 25 percent of all – local and regional merchants.

“Our transition to EMV has been very smooth, the team learned the new system easily and our customers have taken to it seamlessly. EMV has meant business as usual for us,” said Brittany Nassar, business manager of Sugarloaf EyeCare, an optometry center and upscale eyewear retailer in Duluth, GA.

To drive further collaboration and progress, MasterCard announced today it is working with other payments networks, acquirers, and processors on a standard to speed checkout times. These efforts will be based on the company’s M/Chip Fast solution, specifically designed for environments where faster transaction times are particularly important. It builds on the principles of contactless or “tap-and-go” technology helping to speed EMV transactions and shoppers through checkout lines. Testing and certification for M/Chip Fast is streamlined for efficient adoption.

“The whole point of EMV is to reduce counterfeit card fraud,” said Chiro Aikat, senior vice president of product delivery – EMV for MasterCard. “We are impressed with the progress that’s been made so far. We’re taking these steps today to continue the pace of adoption. Making our M/Chip Fast technology available to all parties is our latest investment in this ongoing commitment.”

The chip cards and terminals are already having an impact. Based on MasterCard fraud reports from a compilation of large chip-enabled U.S. merchants:

Counterfeit card fraud basis points at those merchants have decreased by 39 percent in January 2016 as compared with January 2015 Counterfeit fraud at those merchants has decreased by 27 percent in terms of their overall U.S. dollar volume in January 2016 as compared with January 2015About MasterCard

MasterCard, www.MasterCard.com, is a technology company in the global payments industry. We operate the world’s fastest payments processing network, connecting consumers, financial institutions, merchants, governments and businesses in more than 210 countries and territories. MasterCard products and solutions make everyday commerce activities – such as shopping, traveling, running a business and managing finances – easier, more secure and more efficient for everyone. Follow us on Twitter @MasterCardNews, join the discussion on the Beyond the Transaction Blog and subscribe for the latest news on the Engagement Bureau.

Media Contact:

Beth Kitchener

914-249-2058 or This email address is being protected from spambots. You need JavaScript enabled to view it.

Tweet: #ApplePay is officially live in #Singapore for #MasterCard cardholders, a 1st for our customers in #Asia | More here: http://news.mstr.cd/1TI5Bru

SINGAPORE, 25 May 2016 – MasterCard cardholders in Singapore can now use Apple Pay to pay in a simple, secure and seamless way.

MasterCard is working with major banks, including DBS, OCBC, POSB, Standard Chartered and UOB, to enable their customers to use their MasterCard credit or debit cards with Apple Pay.

Apple users in Singapore can now use their iPhone SE, iPhone 6s, iPhone 6s Plus, iPhone 6, iPhone 6 Plus and Apple Watch to make purchases in stores equipped with contactless readers, with just a tap of their iPhone and a thumbprint or passcode for verification, or by simply holding their Apple Watch to the card reader. Within mobile apps, payments can be made on iPhone SE, iPhone 6s, iPhone 6s Plus, iPhone 6, iPhone 6 Plus, iPad Air 2, iPad mini 3, iPad mini 4 and iPad Pro.

Recent figures from MasterCard indicate that consumers in Singapore are supportive of the idea of adopting contactless payments. Consumers in Singapore are among Asia’s top three adopters of digital wallets and interest has been climbing steadily with one in four likely to use a digital wallet compared to just one in 20 three years ago.

Security remains a priority in digital transactions

Security and privacy is at the core of Apple Pay. When you use a credit or debit card with Apple Pay, the actual card numbers are not stored on the device, nor on Apple servers. There is a separate token assigned to each of your Apple devices, which means that not only is the token number different from your ‘real’ card number, but it is also prevented from transacting via any other device. When you use your device for a transaction, it is the token and not the real card number that is provided to the merchant. As an added protection for consumers, Apple Pay incorporates extra security features such as Touch ID to authorise every payment. MasterCard’s secure payment platform, MasterCard Digital Enablement Service, is key to enabling MasterCard cardholders to use Apple Pay.

“The biggest change we’ve seen in the payments space recently is the transformation of every electronic device into a shopping device, from mobile phones to watches. The readiness of Singapore’s consumers to embrace mobile payments, coupled with the rapid uptake of mobile payments is quickly changing the dynamics of shopping and transacting online. With Apple Pay, MasterCard cardholders will have the flexibility and assurance to make secure digital payments wherever and whenever they want,” said Deborah Heng, group head and general manager, MasterCard Singapore.

For consumers and retailers alike, every purchase made with a MasterCard using Apple Pay offers all the benefits and guarantees of a transaction with the physical MasterCard – points, cashback and insurance protection.

With the MasterCard Nearby app, a location-based app that identifies retailers that accept contactless payments, cardholders can easily locate shops which accept Apple Pay. These locations are part of the MasterCard contactless global footprint of 5 million contactless terminals in 77 countries around the world.

For more information on Apple Pay, visit: http://www.apple.com/sg/apple-pay/

###

About MasterCard

MasterCard (NYSE: MA), www.mastercard.com, is a technology company in the global payments industry. We operate the world’s fastest payments processing network, connecting consumers, financial institutions, merchants, governments and businesses in more than 210 countries and territories. MasterCard’s products and solutions make everyday commerce activities – such as shopping, traveling, running a business and managing finances – easier, more secure and more efficient for everyone. Follow us on Twitter @MasterCardAP and @MasterCardNews, join the discussion on the Beyond the Transaction Blog and subscribe for the latest news on the Engagement Bureau.

Contacts:

Venture Liang, MasterCard, This email address is being protected from spambots. You need JavaScript enabled to view it., +65 6390 5973

Celina Lim, Weber Shandwick, This email address is being protected from spambots. You need JavaScript enabled to view it. , +65 6825 8075

By Colin Stretch, Facebook General Counsel

Last week we met with Chairman of the U.S. Senate Commerce Committee John Thune to describe our investigation in response to anonymous allegations of political bias in our Trending Topics feature and to discuss the preliminary results of our work. Today, we sent Chairman Thune a follow up letter setting out our findings and conclusions. As we explain there, suppressing political content or preventing people from seeing what matters most to them is directly contrary to our mission and our business objectives and the allegations troubled us deeply. We are proud of the platform and community we have created, and it is important to us that Facebook continues to be a platform for all ideas.

As soon as we heard of these allegations, we initiated an investigation into the policies and practices around Trending Topics to determine if anyone working on the product acted in ways that are inconsistent with our policies and mission. We spoke with current reviewers and their supervisors, as well as a cross-section of former reviewers; spoke with our contractor; reviewed our guidelines, training, and practices; examined the effectiveness of our oversight; and analyzed data on the implementation of our guidelines by reviewers. We also talked to leading conservatives, to gain valuable feedback and insights.

Our investigation has revealed no evidence of systematic political bias in the selection or prominence of stories included in the Trending Topics feature. Our data analysis indicated that conservative and liberal topics are approved as trending topics at virtually identical rates. We were also unable to substantiate any of the specific allegations of politically-motivated suppression of particular subjects or sources. In fact, we confirmed that most of the subjects mentioned in media reports were included as trending topics on multiple occasions.

At the same time, our investigation could not fully exclude the possibility of isolated improper actions or unintentional bias in the implementation of our guidelines or policies. As part of our commitment to continually improve our products and to minimize risks where human judgment is involved, we are making a number of improvements to Trending Topics, including:

Updated terminology in our Guidelines to make them more clear Refresher training for all reviewers that emphasized that content decisions may not be made on the basis of politics or ideology Additional controls and oversight around the review team, including robust escalation proceduresIn addition to these operational efforts, we are also making the following improvements to the product and tools:

We will no longer rely on lists of external websites and news outlets to identify, validate or assess the importance of particular topics. This means we will eliminate the “Media 1K” list, the list of RSS feeds used to supplement the algorithm that generates potential trending topics, and the top-10 list of news outlets. We are also removing the ability to assign an “importance level” to a topic through assessment of the topic’s prominence on the top-10 list of news outlets. We will expand our Help Center content on Trending Topics to provide more information about this feature and how it works.We appreciated the opportunity to discuss these issues with the Chairman. This process has helped us to identify valuable improvements to our service. These improvements and safeguards are designed not only to ensure that Facebook remains a platform that is open and welcoming to all groups and individuals, but also to restore any loss of trust in the Trending Topics feature.

We will continue to work to improve the feature, as well as to seek feedback from people who use our service to make sure we keep Facebook a platform for all ideas.

Simplify Controls Makes It Affordable, Quick and Easy for Businesses to Maximize Online Sales & Protect Themselves from e-Commerce Fraud

Purchase, N.Y. – May 23, 2016 – Further delivering on its commitment to fight fraud, MasterCard today launched Simplify Controls, allowing small- and medium-sized businesses to control, prevent and monitor e-commerce transactions in real time. The solution, a complement to payments platform Simplify Commerce, helps businesses maximize online sales by letting legitimate orders through and keeping fraudulent transactions out.

With a mobile app and desktop dashboard, merchants can easily and quickly customize their fraud settings – such as transaction size, country of origin and repeat transactions. Simplify Controls then auto-declines transactions to meet their risk tolerance and provides merchants with smart alerts so they can stay on top of potentially fraudulent activity.

With a mobile app and desktop dashboard, merchants can easily and quickly customize their fraud settings – such as transaction size, country of origin and repeat transactions. Simplify Controls then auto-declines transactions to meet their risk tolerance and provides merchants with smart alerts so they can stay on top of potentially fraudulent activity.

This is the latest in a string of innovations from MasterCard that offer layered security in both the physical and digital worlds.

“We’re putting powerful fraud prevention literally into the palm of your hand,” says Deborah Barta, Simplify Commerce global lead, MasterCard. “Simplify Controls can help business owners grow sales and breathe a little easier knowing that bad transactions will be declined and good transactions will get through.”

Fraud is a significant concern among small business owners, according to a recent multi-market online survey commissioned by MasterCard. A full 60 percent of the small- and medium-sized businesses surveyed said they do not currently use a fraud prevention tool.

Simplify Controls was developed by the same team that created Simplify Commerce, a uniquely versatile, highly secure and simple payments platform designed to meet small business owners’ needs. Like Simplify Commerce, Simplify Controls is available through plug-and-play software development kits (SDKs) and application program interfaces (APIs) that make integration quick and easy for both developers and businesses. In addition, the solution currently integrates industry-leading fraud scoring from Kount. For each transaction, Kount’s “decisioning” engine will analyze hundreds of relevant variables and activity across the globe in real-time.

Simplify Controls is available in the United States, and is slated to expand to markets around the globe in the next year.

“At MasterCard, safety comes first,” added Barta. “To protect each and every transaction, we’ve brought consumers, merchants and our bank partners multiple layers of technology – like EMV, tokenization, biometrics, MasterCard IQ, MasterCard InControl for Business, location alerts and now Simplify Controls.”

MasterCard helps small businesses manage cash flow and grow sales through a suite of solutions and advice designed to address the day-to-day demands of running a business – operating efficiently, getting paid quickly, simply and securely and easily paying for goods and services.

For more information on Simplify Controls, please visit www.simplify.com/commerce/features/controls.

About MasterCard

MasterCard (NYSE: MA), www.mastercard.com, is a technology company in the global payments industry. We operate the world’s fastest payments processing network, connecting consumers, financial institutions, merchants, governments and businesses in more than 210 countries and territories. MasterCard products and solutions make everyday commerce activities – such as shopping, traveling, running a business and managing finances – easier, more secure and more efficient for everyone. Follow us on Twitter @MasterCardNews, join the discussion on the Beyond the Transaction Blog and subscribe for the latest news on the Engagement Bureau.

Media Contact:

Julia Monti, Global Communications

MasterCard

PH: 914-249-6135

Cell: 914-217-9533

This email address is being protected from spambots. You need JavaScript enabled to view it.

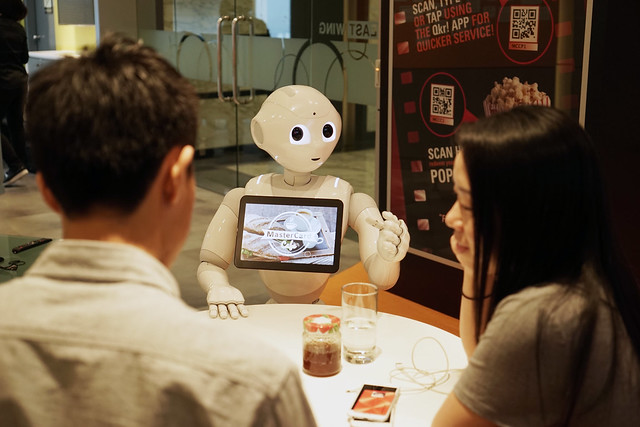

Pizza Hut Restaurants Asia P/L to pilot commerce-based application of Pepper to deliver a range of new in-store consumer experiences

PURCHASE, N.Y. and PARIS, France – 24 May, 2016: MasterCard today unveiled the first commerce application for SoftBank Robotics’ humanoid robot Pepper. The application will be powered by MasterPass, the global digital payment service from MasterCard that connects consumers with merchants, enabling them to make fast, simple, and secure digital payments across channels and devices. Pizza Hut Restaurants Asia P/L will be the inaugural launch partner working together with MasterCard to create innovative customer engagement with Pepper.![]()

A major first step forward in bringing conversational commerce experiences to merchants and consumers, this new app extends the robot’s ability to integrate customer service, access to information and sales into a seamless and consistent user experience. Pizza Hut Asia will be piloting Pepper for order-taking and personalized engagement to enhance customer service in-store by end of 2016.

“Consumers have come to expect personalized service, customized offers and simple and seamless processes both in-store and online,” said Tobias Puehse, vice president, innovation management, Digital Payments & Labs at MasterCard. “The app’s goal is to provide consumers with more memorable and personalized shopping experience beyond today’s self-serve machines and kiosks, by combining Pepper’s intelligence with a secure digital payment experience via MasterPass.”

A consumer will be able to initiate an engagement by simply greeting Pepper and pairing the consumer’s MasterPass account by either tapping the Pepper icon within the wallet or by scanning a QR code on the tablet that the robot holds. After pairing with MasterPass, Pepper will be able to assist cardholders by providing personalized recommendations and offers, additional information on products, and assistance in checking out and paying for items. Pepper will be able to initiate, approve and complete a transaction by connecting to MasterPass via a Wi-Fi connection and the entire transaction happens within the wallet.

“We are excited to welcome Pepper to the Pizza Hut family,” said Vipul Chawla, Managing Director of Pizza Hut Restaurants Asia. “Core to our digital transformation journey is the ability to make it easier for customers to engage, connect and transact with Pizza Hut. With an order-and-payment-enabled Pepper, customers can now come to expect personalized ordering at our stores, reduce wait time for carryout, and have a fun, frictionless user experience.”

The app was built by the MasterCard Labs team in Singapore, one of the company’s eight research and development centers across the globe. The Pepper application adds to ongoing MasterCard programs that bring payments to any consumer gadget, accessory or wearable– from fitness bands to refrigerators and now robots. The integration with Pepper has the potential to open up opportunities in the world of retail such as personalized shopping and concierge services, in-aisle checkout and the ability to buy in store but get the goods delivered at home. The same capability would also be applicable to other consumer engagement locations such as hotels, banks, airports, and other customer service industries.

The app is being showcased at the Pepper Partners Europe event hosted by SoftBank Robotics Europe (a SoftBank Robotics Holdings group company) in Paris from May 24 – 26, 2016.

About MasterCard

MasterCard, www.mastercard.com, is a technology company in the global payments industry. We operate the world’s fastest payments processing network, connecting consumers, financial institutions, merchants, governments and businesses in more than 210 countries and territories. MasterCard products and solutions make everyday commerce activities – such as shopping, traveling, running a business and managing finances – easier, more secure and more efficient for everyone. Follow us on Twitter @MasterCardNews, join the discussion on the Beyond the Transaction Blog and subscribe for the latest news on the Engagement Bureau.

About Pizza Hut:

Pizza Hut, a subsidiary of Yum! Brands, Inc. (NYSE: YUM), delivers more pizza, pasta and wings than any other restaurant in the world. The company began 58 years ago in Wichita, Kansas, when two brothers borrowed $600 from their mom to start a pizzeria.

What started out small has become the biggest pizza company in the world and today operates more than 16,000 restaurants in over 100 countries serving innovative pizzas, traditional favorites like the signature Pan Pizza, and much more. For more information, visit www.pizzahut.com.

MEDIA CONTACT:

Chaiti Sen

MasterCard

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

Contact #: 914-263-6542

MasterCard Humanitarian Aid Solutions Will Enable Beneficiaries to Access Aid from NGOs through a Single Prepaid Card

Istanbul, Turkey (May 23, 2016) – Tens of millions of people around the world receive vital humanitarian aid every year and the need continues to grow exponentially. In many cases, they are not only faced with an immediate crisis, but they also lack the financial services to guard against future risk as they attempt to build better lives.

MasterCard today announced at the World Humanitarian Summit that it plans to expand its aid distribution services with the launch of MasterCard Humanitarian Aid Solutions, which leverages MasterCard Aid Network, MasterCard SendTM and prepaid capabilities, as well as partnerships in the financial services industry. Through the new solution, MasterCard aims to provide beneficiaries with faster access to various forms of aid, including digital cash and vouchers, from non-governmental organizations (NGO) through a single card.

NGOs will be able to deliver more secure and efficient aid and recipients will have access to basic financial tools that create dignity, empowerment and economic opportunity after an immediate crisis is over. World Vision, which has been partnering with MasterCard to improve humanitarian aid delivery via digital identity and electronic payment technology, plans to pilot the new solution.

“MasterCard has been working with international agencies for the past several years to help transform aid delivery,” said Paul Musser, vice president, International Development, MasterCard. “The expanded services we are creating deliver on the insights from these activities. We will be able to eliminate the need for beneficiaries to have multiple cards to access aid from different NGOs, while providing them with an infrastructure for long-term financial inclusion.”

MasterCard Humanitarian Aid Solutions will provide an open and flexible network to make complex digital requirements simple for partners to implement. By expanding the MasterCard Aid Network to leverage other MasterCard products, services and partnerships, recipients will be able to have one card with both a reloadable prepaid account and their MasterCard Aid points account. NGOs will be able to use MasterCard Send to disburse additional funds whenever needed, quickly and securely.

In addition, partners will able to tap into the data analytics capabilities of MasterCard Advisors for valuable insights to help them drive greater operational efficiencies.

“As part of the development of its cash-first approach for its humanitarian responses, World Vision aims to launch a pilot in 2016 of the MasterCard Humanitarian Aid Solution coupled with the Last Mile Mobile Solution,” said George Fenton, Director of Humanitarian Innovation and Partnering of World Vision. “This will allow World Vision and MasterCard to explore beneficiary identity, commodity distribution, and cash access best practices, all on a single card. World Vision aspires to preposition this combination of services so that they can deploy it globally, empowering those in need and increasing aid transparency.”

This expanded service continues the company’s effort to leverage its core expertise to create highly scalable and impactful programs with the development community, including the recently announced partnerships with World Vision and UN Women. Since its launch in September 2015, MasterCard Aid Network has been rolled out by Mercy Corps, Save the Children, and World Vision in countries including Ethiopia, Nepal, Niger, Nigeria, the Philippines and Yemen.

About MasterCard

MasterCard, is a technology company in the global payments industry. We operate the world’s fastest payments processing network, connecting consumers, financial institutions, merchants, governments and businesses in more than 210 countries and territories. MasterCard products and solutions make everyday commerce activities – such as shopping, traveling, running a business and managing finances – easier, more secure and more efficient for everyone. Follow us on Twitter @MasterCardNews, join the discussion on the Beyond the Transaction Blog and subscribe for the latest news on the Engagement Bureau.

Media Contact:

Marisa Grimes

This email address is being protected from spambots. You need JavaScript enabled to view it.

Mobile: 914-325-8367