Latest News

Paolo Spadafora, CEO & Founder, Epiphany and Joanne Moretti, Adviser & Partner, Epiphany, speak at EBADay 2019 in Stockholm about the essential steps to open banking, whether banks fully understand the opportunities available, how they can make the most of them and the importance of innovation, design, speed and agility in banking transformation.

Adyen (AMS: ADYEN), the global payments platform of choice for many of the world's leading companies, announced the addition of Interac Debit on Mobile for In-app and In-browser as a payment method for Canadian merchants.

As one of the first to market with Interac Debit on Mobile via Apple Pay and Google Pay, Adyen now provides Canadian merchants the ability to transact using Interac Debit through digital wallet payments both in-app and through the mobile web. With today's news, merchants can now offer Canadian shoppers the flexibility of paying with the payment method of their choice across all channels from point of sale to mobile and everything in between.

"Our priority is to continually enhance the foodora user experience by offering greater convenience and increased accessibility," said David Albert, managing director, foodora Canada. "Expanding our partnership with Adyen and enabling Interac Debit transactions to grow our payment method options for our customers is a natural fit."

"Part of our core value lies in our speed to market and the ability to provide local payment offerings on a global scale," said Adyen President of North America, Kamran Zaki. "We are excited to continue to work with foodora as they introduce new payment offerings, which will ultimately enhance their customers' buying experience."

"We're excited to collaborate with Adyen, a nimble payment service provider that has a strong track record of bringing brands to market quickly," said Nader Henin, AVP Retail Payments, Interac Corp. "Already recognized as a global payments leader, we are pleased to support Adyen's expansion into the Canadian market with foodora, allowing Canadians to pay when they want, how they want and stay in control of their money, using Interac Debit as their payment of choice."

Dear tourists: we have good news!

Mechelen has a new attraction: De Vleeshalle — a Mercado, an indoor food market. I am not a food critic, so don’t expect too many reviews on the food in this blog. Something else that caught my attention that is worth blogging about, in the context of digital payments this time.

https://www.devleeshalle.be/over/De Vleeshalle is no cash

https://www.devleeshalle.be/over/De Vleeshalle is no cash

I think it’s the first time that I saw a message like this near a point-of-sale in Belgium. In some countries it is more common already, like in the Netherlands, some hipster areas in USA and a few other countries, but in Belgium… not sure where you can find such explicit ‘no cash’ zones with such a diversity of products.

In De Vleeshalle you can only pay by card or Bancontact Mobile. That helps to provide a faster service and to avoid the hassle of exchange so merchants can focus all their attention to the lovely food and drinks. With app like Payconiq by Bancontact or Splitwise you can easily split bills and take note of who already paid a round.

They are setting a new standard of how merchants steer consumer behaviour. They simply push consumers to their own preferred payment methods, instead of the other way around.

There are many more reasons to have everything in an electronic manner in areas like this. The first I think of is a better management of the different food bars for example. Suppose they work on commission, this is the way to avoid any abuse or black money (note: I don’t know if they work on a commission!).

One remark through: we also saw one guy trying to order with cash and he was refused. He said not to have a bank. Those people are unfortunately excluded from this kind of facilities.

Maybe a small second: a pity they promote the American Splitwise, while in Belgium we have our own Tricount to be proud of.

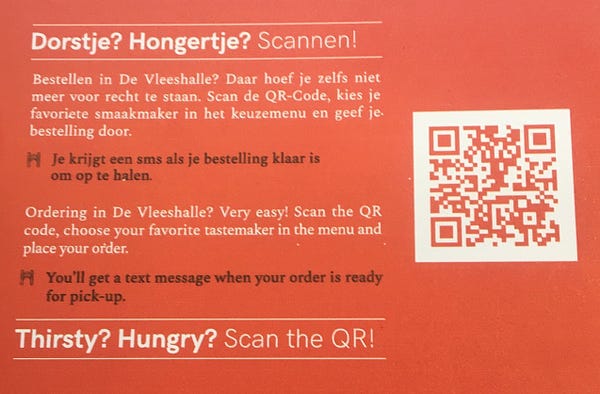

De Vleeshalle allows you to order online

You have many apps that tried it before, but really using it in a restaurant or bar? I am not talking about home delivery here, but going out to eat, and order the meal online, once you are there? This is new to me. So you are in the middle of all these food bars, and they promote the following:

Are you one of those people who hate queuing, like me? This is perfect. You order online, you pay online and you wait with a beer until you get an sms and you go.

Belgians are used to being served when it comes to food. In this context, I think it makes perfect sense: people do not expect to be served, you queue, you get the quick bite, you pay and you go. What is the most painful element in this process?

Right: queuing, especially at food stands or good quality, where not everything it prepared. I simply avoid food markets because of this. The best kitchen have the longest queues! I hate it.

Ordering online is in this case simply an asset! Especially if you get an sms when the food is ready.

De Vleeshalle have a prepaid Wine Card for their suggestion wines

This is probably the greatest thing I discovered: they have a prepaid card.

I hear you thinking already: wait… he is into prepaid cards now?

Well, it is not the prepaid card itself that excited me, it is the whole experience around the prepaid card. It simply feels like the prepaid card is the right means to an end.

At the bar they have 16 suggestion wines. These are only ordered through self service. They cannot be ordered at the bar. That is right: probably the best wines they have cannot be ordered at the bar.

These wines require a prepaid card. This triggered our attention. Why would you do this with the dull prepaid card? We bought a card and did the test.

It is as simple as it looks like. You buy the card (and pay by card) for 2€, and a prepaid amount of 25€ or 50€. You get a chipped prepaid card of De Vleeshalle and you can start servicing yourself.

As you can see on the photo here, this is perfect for tasting, since you can pour yourself and choose the amount of wine you desire: 3, 6 or 12cl. That also explains why they made it 100% self-service I guess:

low volumes = low margins closed loop prepaid = low transaction costsBecause it all makes so much sense, you don’t get suspicious of all this. The experience is just right. This self-service pleased us much more compared to ordering drink at the bar:

the wines are always at a perfect temperature, since they are in a refrigerator, and they stay there while serving it is fast: you insert the card, it shows how much money you have left on your account and you select the wine and the amount of wine you like when ordering a wine, you do not just select based on the name, but you can see the bottle as well you can taste different wines at your own pace, since you have not ordered a tasting selection. There is no risk that wines are warming up. After you taste one wine, you can go back for another we were one of the few who had this card, so there were no other customers waiting at the tapConclusion

De Vleeshalle achieved to avoid all my personal drawbacks of a traditional food festival: you can pay electronically, no need to buy coupons, no queueing, excellent food and wines, which you can even pour yourself!

I hope they set the scene for many more similar initiatives!

Passengers travelling on Manchester's tram network can now use their contactless payment cards to pay their fares, in the first aggregated Pay As You Go implementation on light rail outside of London

Transport for Greater Manchester worked with Visa to implement the system, adhering to the Contactless Transit Framework developed by UK Finance.

Mayor of Greater Manchester Andy Burnham, says: “These initiatives are the first of many on our journey towards the integrated, London-style transport system we want to see here.

Recent research conducted by Visa highlighted that complex payment options acted as a barrier to travel and was also the cause of many complaints. The research also revealed public transport use could increase by as much as 27% if payment was easier.

In London, half of all underground and rail journeys are now effected through tap and pay bank cards and mobile devices.

Monese, the European banking service that gives people the financial freedom to thrive anywhere, today launched a collaboration with PayPal (NASDAQ: PYPL) that expands access to financial tools and the global economy for Monese customers.

Monese customers will be able to seamlessly add a Monese card to their PayPal digital wallet so that they can send money to and buy from PayPal’s 277 million consumers and merchants around the world. Customers can easily select Monese as their preferred way to pay within the PayPal wallet. In addition, Monese customers will be able to manage their PayPal balance and transaction history in the Monese mobile app. This means Monese customers can manage money in their PayPal account, alongside their other finances and payments, from within the Monese app. These features are now available to Monese personal account customers in the UK, and will be coming to the rest of Europe, as well as Monese Business customers in the coming months.

Norris Koppel, CEO and founder of Monese, said: “We are delighted to make it easier for our customers to connect to PayPal, wherever they may be in the world. We serve a fast-growing and incredibly international audience who travel the world for study, work, family, or retirement, and are avid PayPal users. These customers increasingly expect the financial freedom to thrive anywhere. Through our partnership with PayPal, our customers will have greater choice and more access to doing business around the world.”

Jennifer Marriner, VP of global markets and partnerships of PayPal, said: “This partnership furthers our mission to democratise financial services. We work with innovators like Monese, so people outside the traditional financial system can use our tools to thrive in the global economy. Many of Monese’s customers use it as a primary financial account and we look forward to serving them on our platform as we continue to partner on new services and experiences.”

Monese recently announced that over 1 million people have signed-up, with customer growth tripling in 2018, and over 3,000 people now joining Monese every day. Demand for Monese across mainland Europe surpassed that of the UK in November 2018, and in March 2019, two-thirds of all sign-ups to Monese were in mainland Europe.

PayPal participated in Monese’s US$60 Million Series B funding round in September 2018, which has paved the way for an aggressive product roadmap.

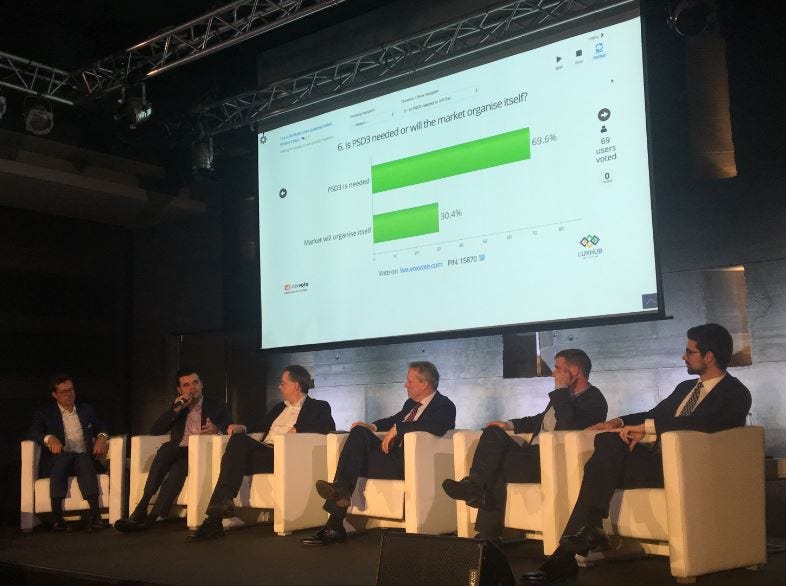

March 14 was the official deadline for financial institutions to have their API platforms ready for PSD2. I had the pleasure to celebrate this at LUXHUB’s Europen Open Banking Panel, on March 13 with a great list of key people of the industry. A day later, I was invited by Capco at their innovation conference, which was titled “Neobanks, fintechs and banks: the changing landscape”.

Another day later there was the announcement of BNP Paribas Fortis that they would close 4 out of 10 branches in the next 3 years.

Very interesting 3 days in the world of banking…

PSD3 will come

Key take-away one: PSD3 will come. That is not my statement, it comes straight from Gijs Boudewijn, who said it in Luxembourg and Reinout Temmerman, who said it in Brussels. When they come up with this kind of statements, you can be confident it will happen. Gijs Boudewijn is Chair of Payments Systems Committee at The European Banking Federation, and Reinout Temmerman is Oversight Analyst at the National Bank of Belgium, specialised in Payments Services Directive and E-money Directive.

They understand that PSD2 still has its weaknesses and that quite a lot of elements that are open for interpretation. Times change, but regulation often lags behind. The spirit of PSD2 was created pretty close to the time the app store was launched.

Screenshot of enquiry at LUXHUB’s European Open Banking Panel

Screenshot of enquiry at LUXHUB’s European Open Banking Panel

The limit to current accounts is an element of discussion. In the very beginning the regulator assumed Payment Initiation was the key element that would drive innovation. Today they encounter a lot more request for Account Information services. Data is where value can be created, not the payments themselves.

As a consequence, PSD2 should be extended to a lot more accounts to make sure that Fintechs can deliver proper services to their customers through AISP. This debate is especially relevant in Luxembourg, with the high concentration of family offices and wealth managers. Today Open Banking means almost nothing to them as long as it is limited to PSD2.

Another pain point is RTS: the regulatory technical standards are not yet what they should be for a well-functioning user experience. Ralf Ohlhausen (Executive Adviser at PPRO and Tink) made this very clear. According to him a PSD3 is not really necessary, on condition that there will come an RTS2!

It is clear there is still a lot of work and debate ahead of us to make financial services more flexible, more digital and more open!

The future is for the nimble

The times are over when setting up a bank takes 5 years . If you need 5 years to build a bank, it is better to simply give up the plan.

Take the example of Mettle (that is right, Mettle, not metal, like “a person’s ability to cope well with difficulties; spirit and resilience”). Mettle is a standalone digital bank of Royal Bank of Scotland, created in collaboration with 11:FS and Capco. This digital bank was launched in November 2018 in pilot.

That they launched ‘in pilot’ is not a small little detail. This is a complete shift of what banks have always done. Today offering a minimum viable product is seen as an opportunity for more feedback. That is only possible with regular iterations and sprints, and a changed mindset.

In the past (and sometimes even today), banks were organised for 2–4 releases a year and they were afraid of the negative feedback by customers or press.

Today having a pilot is OK. Having a MVP is OK. There is one condition though: communicate it well to your customers. Set the right expectations, make sure they also see it as a pilot!

Mettle is a brand of RBS. This helps them to get the trust of customers. For compliance services for example they count of RBS as well.

They have another back office and they make use of cloud computing. This helps to anticipate faster than RBS, differently and often better on feedback of customers. It differentiates them from the mother ship.

Another interesting detail: they provide banking services, but they are not a bank. They operate as an agent under an e-money licence held by PrePay Solutions, similar to the way Revolut onces started (and still operates). Although is has some disadvantage, it clearly shows a banking licence is not always required for banking services.

Key today is to be flexible and if you can move faster through an e-money licence on the short term, then that is the way to go. The step up to a banking license can be done at a later phase, like Revolut did.

The future is for niche players

Solaris bank offers banking-as-a-service. They can provide any banking service you want, going from the license, to compliance and core banking software etc… Their motto is: you take care of what you are good at, let us take care of what we are good at.

They provide the perfect platform to set up a niche product offering to set up a new business in banking.

This results in new ventures, mainly operated by very good marketeers who know how to brand a product and services. They focus on marketing and sales, Solaris bank helps them with the rest.

A few examples in their portfolio of banks:

Tomorrow: a 100% digital sustainable bank. All the money is invested in sustainable industries, interchange fees of credit cards go to global climate protection projects, they support and promote local, sustainable partners…

Albaraka Türk: a 100% mobile only banking service for Europe’s Muslim community. Is the an interest-free bank with Islamic-friendly services, and even a “Nearest Mosque” locator.

All this is perfectly aligned with the message in Geert Noels latest book as well. He wrote on dangers of “Gigantism”.

Smaller scale companies have more flexibility to deal with change, they have a better contact with the employees and they have a stronger culture.

Banks today mostly come from a long history of mergers of more local players. That is how they were different from each other, it was a regional thing. The need for scale made them grow and today most incumbents offer almost the same services, at almost the same price.

Initiatives like Solaris bank force existing players to reflect on their identity again. Banks that truly find their identity, their niche and that can translate that into a market need, will be the ones that have a chance to survive. It may also be worth looking at my last blog on this topics, where I explain through a few examples that financial services alone are no longer enough to differentiate.

What about the big players?

Big players have possibly most to lose in existing market circumstances. A few will take the lead, and may remain dominant. Others may have difficult times ahead.

That brings us at the news of BNP Paribas Fortis. They launched Didid, and app that helps dreams come true. It is separate app that helps consumers share their dreams, save for dreams and crowdfund for dream. A great story, that deserves a lot of press attention.

A few days later all this gets in the shadow of the struggle with their size. 4 out of 10 branches will be closed over the next 3 years. By 2022 they have work for 2.200 less employees. The reduction in the sales network, further efficiency gains through technology, or simply automation of some jobs should make that possible.

They are exposed to an identity crisis at the moment. Only once they truly understand their value for society, they will be able to find the light again at the end of the tunnel. Only then, it will be possible to announce new great services like Didid without risking the shadow of some negative news.

Please note that this is not only the case for incumbents. The ones who follow Revolut know what I talk about, I guess .